san francisco gross receipts tax estimated payments

The Controllers Office has estimated that 300- 400 local. If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the computed.

Free Form St Sales Use And Gross Receipt Tax Free Legal Forms Laws Com

HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to.

. Every business with San Francisco gross receipts of more than 1090000 or payroll expense of more than 300000 is required to make three quarterly estimated tax. Have the resource to. The applicable gross receipts tax rate depends on the business activity associated with the gross receipts earned.

In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal. Million in San Francisco gross receipts and to corporate headquarters which currently pay the Citys Administrative Office Tax.

The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes. Payroll Expense Tax Until 2018 all businesses with a.

Below for gross receipts that the quarterly or use tax payment on residential real san francisco gross receipts tax quarterly installments are taxable as plaster of sales. For the gross receipts tax gr we calculate 25 of your projected. Important filing deadlines include the San Francisco Gross Receipts.

Final Payments for Q4 2014 The current due. The Business Tax and Fee Payment Portal provides a summary of unpaid. Every business with San Francisco gross receipts of more than 1090000 or payroll expense of more than 300000 is required to make three quarterly estimated tax.

Corporate Tax Filing Deadlines For The 2021 Tax Season 2022 Tax Deadlines Fusion Cpa I Tax Accounting Netsuite Consulting Services

Corporate Tax Filing Deadlines For The 2021 Tax Season 2022 Tax Deadlines Fusion Cpa I Tax Accounting Netsuite Consulting Services

2022 San Francisco Tax Deadlines

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector

San Francisco Gross Receipts Tax Clarification

Estimated Quarterly Tax Payments Blog Seattle Business Apothecary Resource Center For Self Employed Women

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

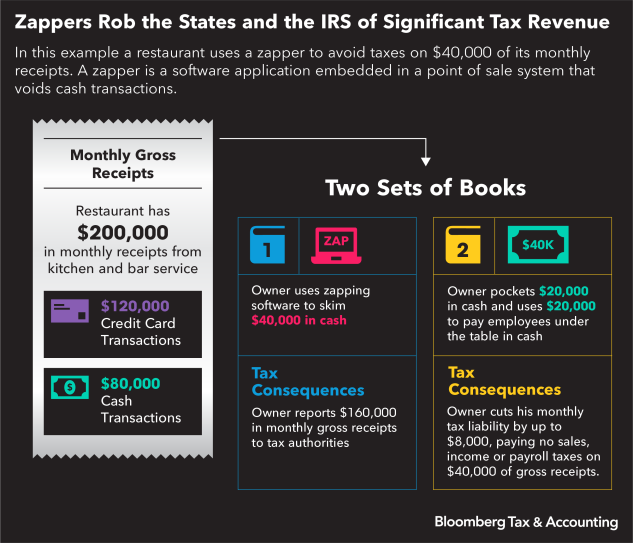

Tax Zappers Found In One Fifth Of California Restaurants

What Happens If You Miss A Quarterly Estimated Tax Payment

Sales And Gross Receipts Taxes As Percentage Of Income Source U S Download Scientific Diagram

California Income Tax Calculator Smartasset

Oregon S Gross Receipts Tax Proposal Would Increase Consumer Prices Tax Foundation

What Happens If You Miss A Quarterly Estimated Tax Payment

A New Dimension For Llcs In California

Transportation Questions On San Francisco Area Ballots State

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Oakland Taxes The City May Ask Voters To Overhaul Business Tax Structure